B2B Lead Gen Has a Ceiling. Awareness Removes It.

Most B2B lead gen problems aren’t pipeline issues, they’re awareness issues. Learn why demand capture has a ceiling and how awareness unlocks scalable growth.

If you’re like a lot of B2B teams we speak to, the story goes something like this:

“Leads are down.”

“CPCs are up.”

“Sales says all the leads are rubbish.”

So you squeeze the platforms a bit harder.

You push more budget into bottom-of-funnel campaigns.

You spin up another “Book a Demo” ad.

And still… pipeline feels flat.

In most cases, this isn’t a lead gen problem. It’s an awareness problem.

Seven Signs Your Lead Gen Problem Is Actually an Awareness Problem

Here are the patterns we see again and again:

- Branded search volume is tiny

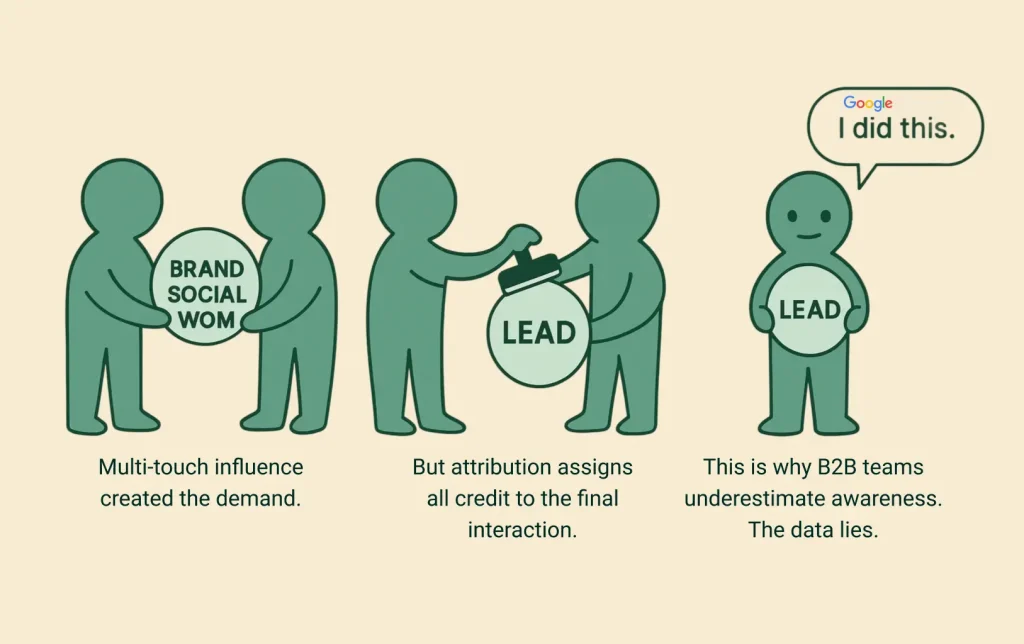

- Most leads come from referrals, networks or events (yet Google claims last-click attribution)

- Sales hears “never heard of you” far too often

- Retargeting pools are small

- Creative is almost entirely bottom-of-funnel

- MQL count defines success

- Google carries the entire revenue target

If any of these sound familiar, your pipeline isn’t broken. Your awareness engine is underdeveloped.

How Our Beliefs Changed

In the early years at farsiight, we built almost everything around demand capture.

Google handled most of the heavy lifting. Meta was barely touched because we couldn’t nail the audience targeting,. And all our campaigns were conversion-optimised because that’s what every performance playbook tells you to do.

But the more we defined our ICP, the more obvious the issue became which was two-fold:

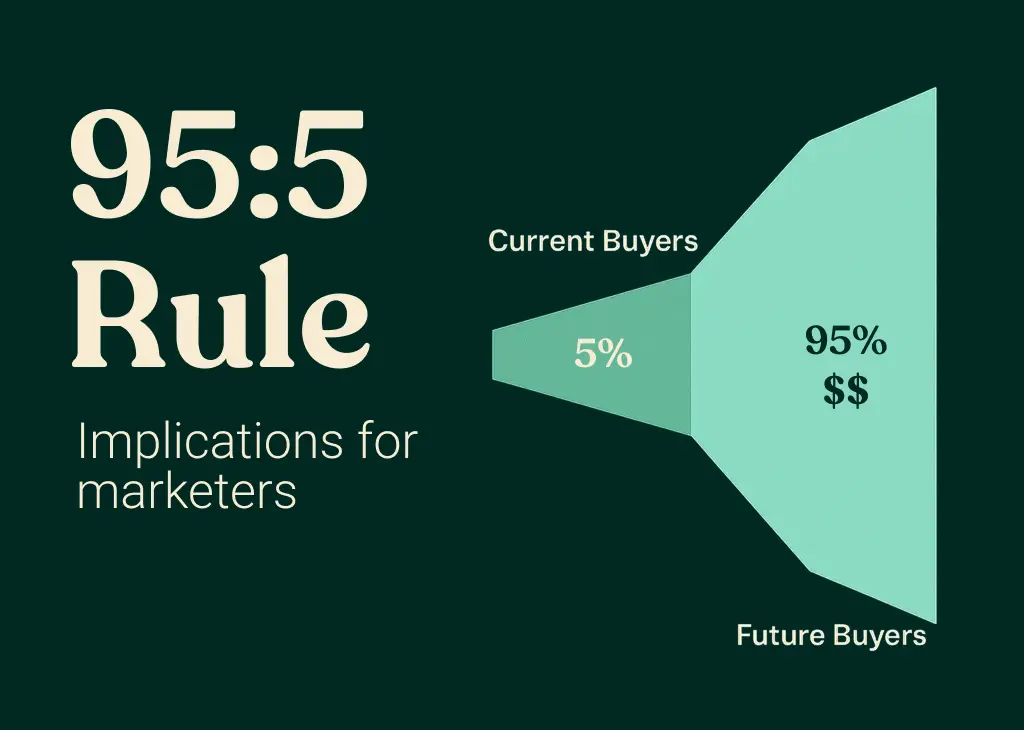

1/ The 95:5 rule was working against us

Research from the LinkedIn B2B Institute and Ehrenberg-Bass shows that only around 5% of B2B buyers are actively in-market at any given time, while the remaining 95% won’t buy for months or even years.

By relying almost entirely on intent-based channels, we were competing for the same tiny pool of buyers over and over again. If those buyers weren’t searching that week or that quarter, our pipeline stalled, not because our offer changed, but because the in-market audience simply wasn’t big enough.

2/ We had a very specific ICP, and broad channels couldn’t reach them predictably

Our ideal clients are B2B, tech or SaaS companies with more than 10 employees, operating in AU/NZ, often with longer sales cycles and multiple stakeholders involved in the buying process.

When your ICP is that defined, broad channels like Google and Meta, especially when used with BOF objectives, struggle to consistently reach the right companies. We were relying on intent that wasn’t consistently there, and our pipeline became too dependent on whoever happened to type the

right keyword that month.

That’s when it became obvious:

We didn’t have a lead gen problem.

We had a precision and awareness problem.

Everything Changed When We Went All-In on Demand Generation

Once we shifted to an ABM-aligned demand-generation motion, everything changed.

We began targeting only the companies we actually wanted as clients. TOF investment became safer and more measurable.

We could finally see:

- which accounts were warming

- which were showing repeated engagement

- which were progressing into SQLs and opportunities

Lead generation became predictable again, not because of a hack, but because awareness was finally targeted, measurable, and aligned to our ICP.

How We Did It

1. We rebuilt our media mix

We prioritised channels that could reliably reach our exact ICP, not broad audiences.

LinkedIn Ads became our primary awareness engine.

2. We rebalanced using the 95:5 rule

We started creating content for the 95% of our TAM who are out-of-market, while still capturing the 5% actively evaluating solutions.

3. We overhauled measurement & attribution

We added new KPIs, attribution tools, and account-level visibility to understand which companies were warming long before they converted.

4. The outcome

Pipeline grew by 55% in just 120 days

Demand Capture vs Demand Creation

Most B2B marketing teams default to demand capture. Competitor campaigns, high-intent Google Ads, lead forms and demo CTAs, Capterra/G2 Crowd all fall into this bucket. We run these intentionally, but they only work if demand already exists.

If your ICP doesn’t recognise your brand, doesn’t understand the problem the way you frame it, or isn’t convinced your solution is built for companies like theirs, they can still convert, but it becomes significantly harder.

Demand creation is where growth comes from. It’s the work that:

- Gets your brand in front of the right accounts early

- Builds recognition and preference

- Educates buyers about the problems they haven’t solved yet

- Shapes your category before they enter the market

Awareness isn’t “brand fluff.” It’s future pipeline.

What Effective Awareness Looks Like in Modern B2B

High-performing B2B companies treat awareness as a commercial priority. They are deliberate about who they target, what they say and how often they say it.

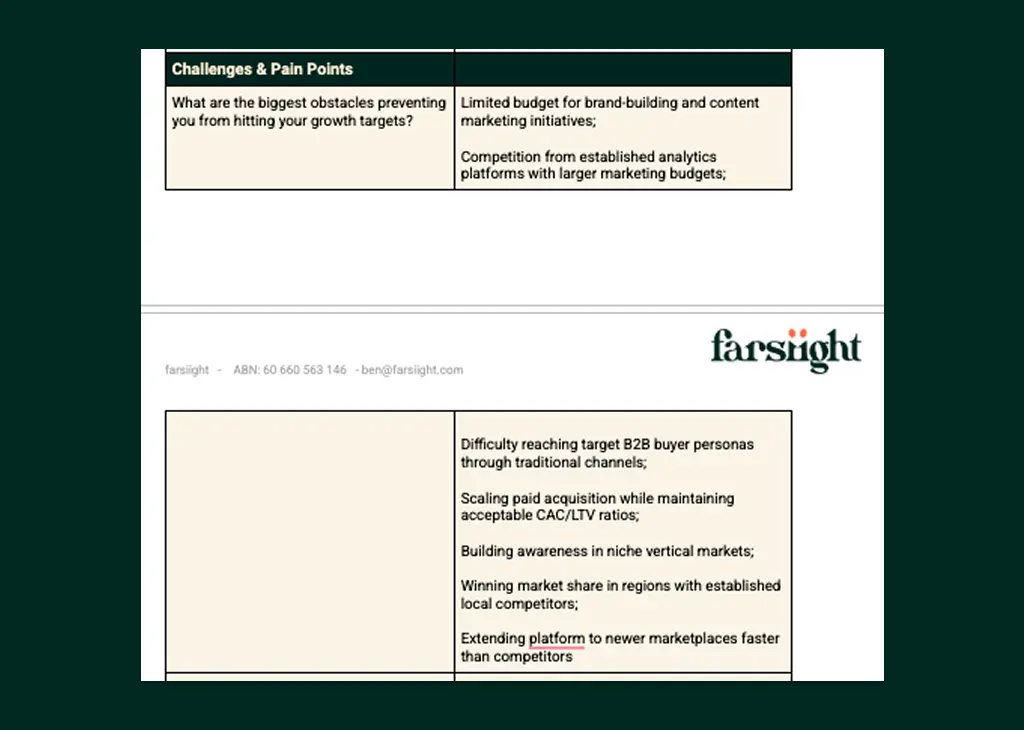

1. They Build Awareness Around Buying Triggers

The best B2B marketers don’t just rely on pain points. They understand the moments that push buyers from “out-of-market” to “in-market,” and they design their TOF content around those moments.

It’s things like when the board asks for pipeline clarity, when sales can’t articulate value, when channels flatten even with more budget, or when a competitor suddenly feels louder.

Buyers remember content that speaks directly to the moment they feel pressure.

Instead of posting “3 ways to improve B2B lead quality,” a trigger-based TOF post might be:

“Your board wants pipeline clarity. Here’s why your CRM is lying to them.”

At farsiight, we source buying triggers directly from fact finding sheets and call transcripts then build TOF content that anchors to those exact moments and pain points.

Screenshot from our fact-finding sheets where we learn voice of customer

2. They Prioritise Message Consistency

Buyers don’t remember the one brilliant post you wrote. They remember the ideas you reinforce consistently.

Strong B2B brands choose a handful of messages that matter and deliver them across TOF, MOF and BOF. This creates familiarity, which eventually becomes preference.

Consistency builds mental availability because it reduces cognitive load, buyers begin to associate specific ideas with your brand.

If your POV is “Dashboards don’t change behaviour. Insights do.” that message should appear:

- in your thought-leadership ads

- in your sales calls

- on your website

- in your case studies

Different formats. Same POV. That’s what builds familiarity and, eventually, preference.

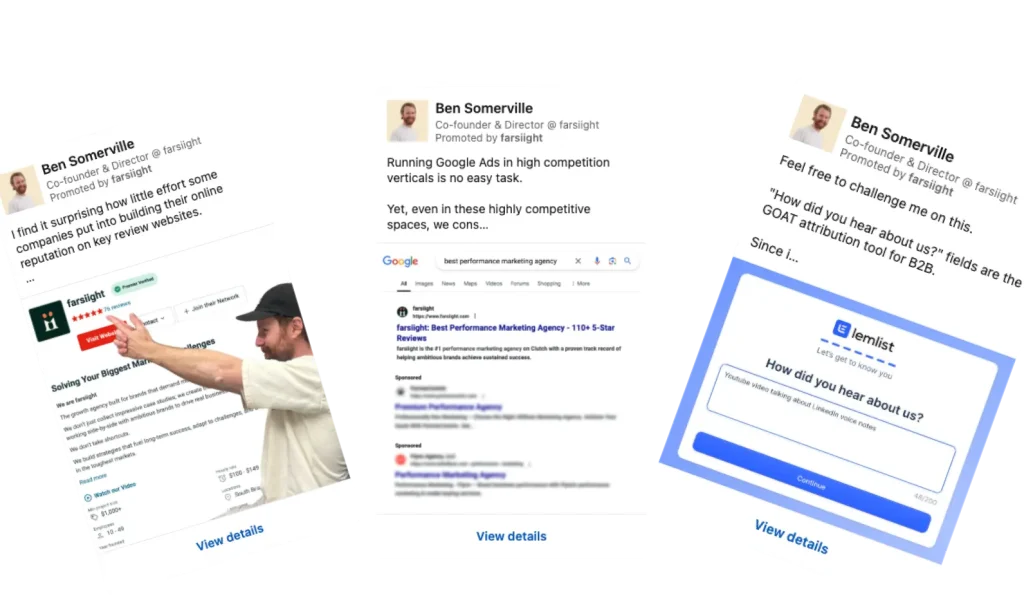

3. They Build a Distribution Engine, Not Just a Content Habit

Publishing content isn’t enough. Modern B2B marketers focus on getting their message in front of the right people with the right frequency. That includes:

- thought-leader ads

- TOF paid social, often through LinkedIn Ads

- sequencing TOF → MOF → BOF

- diversified creative formats

- account-level reporting to understand which companies are warming

A CEO narrative post may do well organically, but:

Turning it into a thought-leader ad ensures every VP of Revenue in your ICP sees it, not just whoever the algorithm felt like showing it to that day.

Screenshots from our LinkedIn Ads thought leadership posts

4. They Instrument the Journey From Awareness to Revenue

Awareness only matters if you can see it in the numbers, and 1-90 day click-attribution models are completely flawed for this.

The best teams track:

- which accounts repeatedly engage

- which accounts later become MQLs, SQLs or opportunities

- Whether branded search is rising

- whether sales conversations start closer to the problem

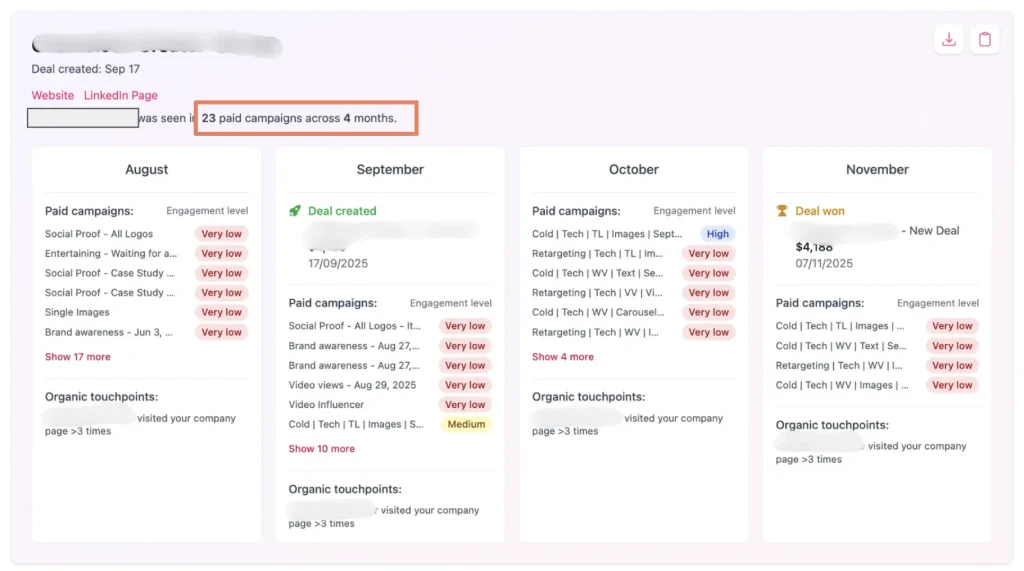

Take us, for example, a recent client we closed saw 23 paid ads across 4 months. Which ad deserves attribution? When you measure awareness properly, you realise most opportunities begin long before the first click ever happens.

Fibbler customer journey mapping

So… Do You Really Have a Lead Gen Issue?

If pipeline feels inconsistent or declining, the answer may be simpler than you think.

Not enough of the right people know who you are.

Not enough of them remember you.

Not enough of them understand your point of view.

Fix awareness, and you fix pipeline.

If you want help understanding your ICP, building demand creation campaigns or scaling LinkedIn Ads through a TOF-led, ABM-aligned approach, this is exactly what we do at farsiight.

FAQs

Awareness activity typically begins influencing pipeline within 60–120 days, but the most meaningful commercial impact builds over 6–12 months. Here’s why: 1/ Awareness warms accounts long before they convert, so the early signs show up as higher engagement, larger retargeting pools, stronger branded search, and more informed sales conversations. 2/ B2B buying cycles can stretch across quarters, and most opportunities originate long before the first tracked click, meaning early momentum is often invisible in traditional attribution platforms. 3/ As more of your ICP becomes familiar with your brand and POV, BOF campaigns convert cheaper and faster, improving SQL quality and reducing CAC. 4/ Top-of-funnel isn’t an overnight lever, it’s a compounding asset. Once enough of the right accounts know who you are and what you stand for, pipeline becomes significantly more predictable.

Many B2B lead gen programs hit a ceiling because they rely too heavily on demand capture channels like Google Ads or BOF LinkedIn campaigns. These channels only reach the 5% of buyers who are in-market right now. Without awareness activity targeting the remaining 95%, pipeline eventually stagnates regardless of how well BOF activity is executed.

Common signs include small retargeting pools, declining branded search, high CPCs, poor engagement on ads, heavy reliance on Google for pipeline, and hearing “I’ve never heard of your company” in sales calls. These indicate a lack of mental availability, not a lead gen issue.

Pure play lead gen objectives / BOF campaigns target the small percentage of buyers already in-market. Because every competitor is bidding on the same small pool of high-intent keywords or demo-ready audiences, costs rise quickly and the space is constantly changing. As competition increases, CPCs climb and your CAC becomes dependent on auction pressure rather than strategy or brand strength.

Ben Somerville

Ben is our Director at farsiight, with over 15+ years experience in B2B.

Like what you read?

Learn more about digital, creative and platform strategies below.